Are you struggling to manage your finances? Do you find it challenging to keep track of your expenses, save money, and invest wisely? If so, you're not alone. Many people face difficulties in managing their finances effectively, but the good news is that there are practical strategies you can implement to improve your financial situation.

In this article, we will discuss five ways to manage your finances well, from creating a budget to reviewing and adjusting your financial plan regularly.

Why You Should Well Manage Your Finances?

Managing finances effectively is crucial for financial success and peace of mind. It involves making informed decisions about how you earn, spends, saves, and invest your money. However, many people struggle with financial management due to various reasons, such as lack of knowledge, poor spending habits, and unexpected expenses.

Therefore, it's essential to understand the importance of managing finances effectively and the common challenges that people face in this area.

Create a Budget

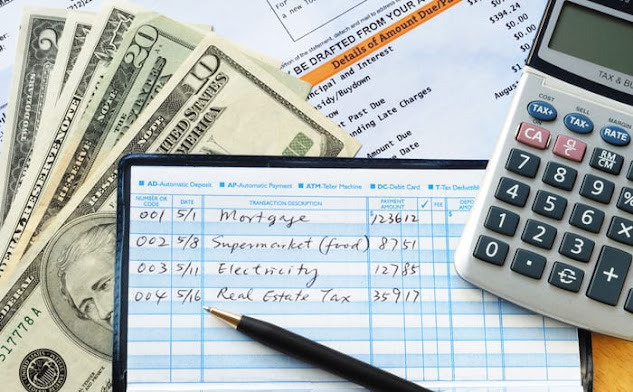

One of the fundamental steps in managing finances effectively is to create a budget. A budget is a financial plan that helps you track your income and expenses, set financial goals, and make informed decisions about how to allocate your resources. Creating a budget allows you to take control of your finances and ensure that you're spending your money wisely.

To create a budget, start by calculating your total monthly income, including your salary, investments, and any other sources of income. Then, list all your monthly expenses, such as rent/mortgage, utilities, groceries, transportation, debt payments, and entertainment. Make sure to include all your fixed and variable expenses to get a comprehensive overview of your spending habits.

Once you have a clear understanding of your income and expenses, you can categorize your expenses into essential and non-essential items. Essential expenses are necessary for your basic needs, such as food, shelter, and transportation, while non-essential expenses are discretionary items, such as dining out, entertainment, and vacations. This categorization will help you identify areas where you can cut back on expenses and save money.

Next, set financial goals based on your priorities and values. For example, you may want to save for emergencies, pay off debt, invest in retirement, or save for a down payment on a house. Assign specific amounts to each goal and prioritize them based on their importance to you.

After setting your financial goals, allocate your income to cover your expenses and save/invest for your goals. Make sure to be realistic and avoid overspending. It's crucial to monitor your budget regularly and make adjustments as needed to ensure you're staying on track.

Here are some tips for effective budgeting:

Be disciplined: Stick to your budget and avoid unnecessary spending.

Be flexible: Life circumstances may change, so be prepared to adjust your budget accordingly.

Keep track of your expenses: Use budgeting apps or spreadsheets to monitor your spending.

Avoid debt: Minimize the use of credit cards and loans, and pay off debts as soon as possible.

Save for emergencies: Set aside some money for unexpected expenses like medical emergencies or car repairs.

By creating and following a budget, you'll have a clear understanding of your financial situation and be able to make informed decisions about your spending and saving habits.

2. Track Your Expenses

Tracking your expenses is a crucial step in managing your finances effectively. It helps you understand where your money is going and identify areas where you can cut back on spending. There are several methods you can use to track your expenses:

Manual tracking: Keep a notebook or use a budgeting app to record all your expenses daily or weekly.

Bank statements: Review your bank statements regularly to track your expenses and categorize them.

Receipts: Keep all your receipts and categorize them to track your spending.

By tracking your expenses, you'll have a clear picture of your spending habits and be able to identify any unnecessary expenses that can be reduced or eliminated.

3. Reduce Expenses

Reducing expenses is an essential part of effective financial management. It allows you to save more money, pay off debt faster, and invest in your financial goals. Here are some strategies to reduce expenses:

Cut back on discretionary spending: Review your expenses and identify non-essential items that can be reduced or eliminated, such as eating out, subscriptions, and entertainment.

Negotiate bills: Contact your service providers, such as internet, cable, and insurance, and negotiate for lower rates or better deals.

Shop around for better deals: Compare prices for groceries, utilities, and other expenses to find the best deals and save money.

Avoid impulse buying: Make a list before going shopping and stick to it to avoid unnecessary purchases.

Reducing expenses requires discipline and mindful spending. By cutting back on unnecessary expenses, you'll have more money to save, invest, and achieve your financial goals.

3. Increase Income

Increasing your income is another effective way to manage your finances well. It provides you with more financial resources to save, invest, and achieve your financial goals. Here are some ideas for increasing your income:

Ask for a raise at work: If you believe you deserve a higher salary, research and prepare a persuasive case to request a raise from your employer.

Look for additional sources of income: Consider taking on a part-time job, freelancing, or starting a side business to earn extra money.

Invest in education and skills: Enhance your knowledge and skills through education, certifications, or professional development to increase your earning potential.

Sell unused items: Declutter your home and sell unused items online or at a yard sale to generate extra income.

4. Save and Invest

Saving and investing are essential components of effective financial management. They help you build an emergency fund, achieve long-term financial goals, and grow your wealth over time. Here are some tips for saving and investing:

Create an emergency fund: Set aside 3-6 months' worth of living expenses in a separate savings account to cover unexpected expenses.

Automate your savings: Set up automatic transfers from your checking account to a savings or investment account to ensure consistent saving.

Diversify your investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate, to minimize risk.

Invest for the long term: Avoid making impulsive investment decisions and focus on a long-term investment strategy that aligns with your financial goals.

Seek professional advice: Consider working with a financial advisor to help you make informed investment decisions based on your risk tolerance and financial goals.

Saving and investing require discipline and patience. By consistently saving and investing for the future, you'll be better prepared to achieve your financial goals and secure your financial future.

5. Review and Adjust Regularly

Managing your finances is an ongoing process that requires regular review and adjustments. Your financial situation may change over time, and it's crucial to adapt your financial management strategies accordingly. Here are some things to keep in mind:

Review your budget regularly: Monitor your expenses, savings, and investments regularly to ensure you're on track with your financial goals.

Update your financial goals: Revisit your financial goals periodically and make adjustments based on changes in your life circumstances or priorities.

Adjust your budget: If your income or expenses change, adjust your budget to reflect your current financial situation.

Stay informed: Stay updated on the latest financial news, investment trends, and tax regulations to make informed financial decisions.

Seek professional help when needed: If you're unsure about managing your finances or need assistance with complex financial matters, don't hesitate to seek professional help from a financial advisor or accountant.

Conclusion

Managing your finances well is a critical skill that can help you achieve your financial goals and secure your financial future. By setting financial goals, creating a budget, tracking your expenses, reducing expenses, increasing income, saving and investing, and reviewing and adjusting regularly, you can take control of your finances and make informed financial decisions.

Remember, financial management requires discipline, patience, and consistent effort. With the right strategies and mindset, you can effectively manage your finances and work towards a financially secure future.

Comments

Post a Comment

Thank you for reaching out to us! We will come back to you shortly.